TenYearsAsKingIsOn

The spot trading is in my watchlist small account.

Pin

TenYearsAsKingIsOn

Old fans from the past and new brothers who have joined!

This post, I will pin it for a while, will detail the return to the real market, how the plan will operate, including positions, leverage, how to manage, how to profit, what is the profit and loss ratio? How to effectively implement the goals step by step.

I am now using my main account that I focus on to publicly share real trading. In a couple of days, I will set up a live streaming room to accompany everyone in real combat, or if any market conditions arise, I will share my ten years of experience to see if I can give you some advice.

View OriginalThis post, I will pin it for a while, will detail the return to the real market, how the plan will operate, including positions, leverage, how to manage, how to profit, what is the profit and loss ratio? How to effectively implement the goals step by step.

I am now using my main account that I focus on to publicly share real trading. In a couple of days, I will set up a live streaming room to accompany everyone in real combat, or if any market conditions arise, I will share my ten years of experience to see if I can give you some advice.

- Reward

- 130

- 11

- Share

EveryDayBigDump :

:

Aren't you going to livestream?View More

Is it just me, or has the system not been updated?

Once again, this return is highly significant. Firstly, it marks my tenth year in the crypto space, and I must achieve results. Secondly, I have dismantled all trading systems from the past decade and rebuilt one that utilizes low leverage to achieve high returns. I aim to manage every market wave with leverage not exceeding 3-5 times, to realize returns of 30-50 times. I seek victory through stability; how can this be achieved?

The real market tells you the truth, whether my positions are liquidated at tens of thousands of dollars? Whether I

View OriginalOnce again, this return is highly significant. Firstly, it marks my tenth year in the crypto space, and I must achieve results. Secondly, I have dismantled all trading systems from the past decade and rebuilt one that utilizes low leverage to achieve high returns. I aim to manage every market wave with leverage not exceeding 3-5 times, to realize returns of 30-50 times. I seek victory through stability; how can this be achieved?

The real market tells you the truth, whether my positions are liquidated at tens of thousands of dollars? Whether I

- Reward

- 1

- Comment

- Share

I checked the account situation, and it is currently the twentieth day.

The entire process uses low leverage of 3-5 times, reducing the risk compared to the previous 10-20 times leverage.

Much lower, adhere to strict risk control, try to enter at key points, utilize

Small leverage, high-frequency arbitrage in a large space, striving to ignore the market as much as possible.

The rise and fall, any fluctuations are beneficial for my use, the real account can be seen, forced liquidation.

They are all very high, with Bitcoin being liquidated at tens of thousands of dollars and Ethereum above sever

View OriginalThe entire process uses low leverage of 3-5 times, reducing the risk compared to the previous 10-20 times leverage.

Much lower, adhere to strict risk control, try to enter at key points, utilize

Small leverage, high-frequency arbitrage in a large space, striving to ignore the market as much as possible.

The rise and fall, any fluctuations are beneficial for my use, the real account can be seen, forced liquidation.

They are all very high, with Bitcoin being liquidated at tens of thousands of dollars and Ethereum above sever

- Reward

- 1

- 2

- Share

TenYearsAsKingIsOn :

:

115000 watershed, see if the rebound has strength, if not, go down directly. Ten days ago, I said BTC would be bearish to 112000.View More

My tenth year in the crypto world.

Share an original copy to motivate the brothers in the market.

The trader's nirvana: from liquidation to reversal, what doesn't kill you will make you stronger.

The market will not pity anyone, but it will reward those indomitable beasts.

There is not a single big shot who hasn't been liquidated, and there isn't a winner who hasn't been tortured by the market to the point of questioning life.

Before Soros shorted the pound, he was repeatedly slapped in the face by the market; Livermore went bankrupt three times, but ultimately made a comeback; Buffett suffere

View OriginalShare an original copy to motivate the brothers in the market.

The trader's nirvana: from liquidation to reversal, what doesn't kill you will make you stronger.

The market will not pity anyone, but it will reward those indomitable beasts.

There is not a single big shot who hasn't been liquidated, and there isn't a winner who hasn't been tortured by the market to the point of questioning life.

Before Soros shorted the pound, he was repeatedly slapped in the face by the market; Livermore went bankrupt three times, but ultimately made a comeback; Buffett suffere

- Reward

- 2

- 4

- Share

KnowledgeAndAction300 :

:

Just go for it💪View More

Benefits from the organization. Ever since Mr. Yu took out his own money to purchase this trap coffee machine, ice maker, and a full set of coffee beans, it has saved us a few hundred dollars every day, as we are coffee lovers.

As for the account situation, what does the order mean?

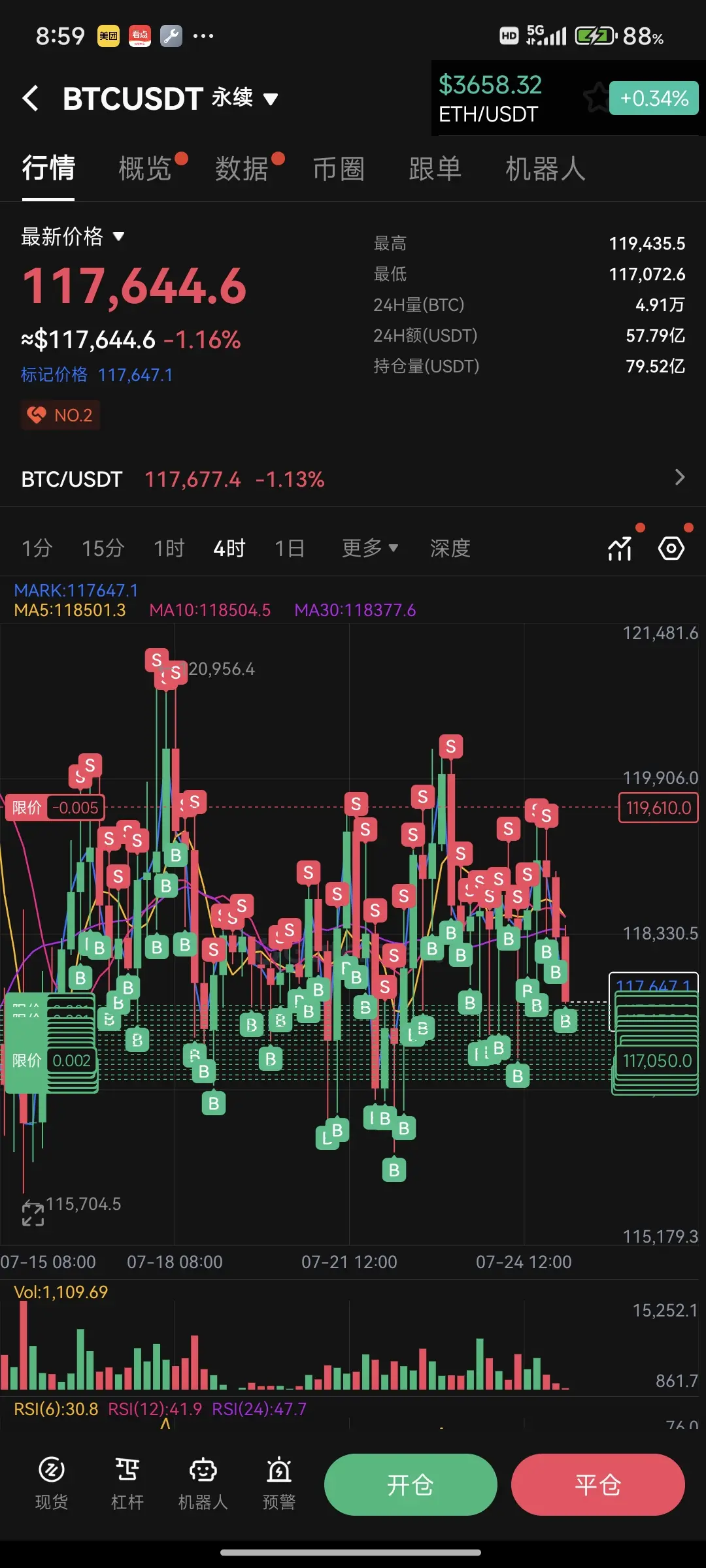

Shorting Ether at 3400, after continuous pinbar operations and price corrections, I made close to 10% of total funds at 3700. Now I'm shorting again at an opening price of 3700, allowing myself to play around a bit, slowly bringing it up to 3900 to see if I can catch a small profit.

For Bitcoin, shorting at 117,000

View OriginalAs for the account situation, what does the order mean?

Shorting Ether at 3400, after continuous pinbar operations and price corrections, I made close to 10% of total funds at 3700. Now I'm shorting again at an opening price of 3700, allowing myself to play around a bit, slowly bringing it up to 3900 to see if I can catch a small profit.

For Bitcoin, shorting at 117,000

- Reward

- 1

- 1

- Share

TenYearsAsKing2025R :

:

The US stock market continues to hit new highs, and the rebound over the past few months has reached new highs; both the technical and fundamental aspects feel quite abnormal. I am relatively afraid of heights regarding the current market situation.Our current strategy for placing orders is to no longer excessively predict the market. We decisively open orders to earn the money we should, and we do not get greedy for orders that we shouldn't earn. We aim to benefit from any sudden market movements.

Because of my ten-year career in the crypto space, I conducted a so-called ten-year in-depth review, experiencing countless black swan events in the crypto world. Among them, in 2014, the Mt. Gox incident saw Bitcoin plummet by 80%, in 2017 the 94 incident resulted in an 80% evaporation of market value, in 2020 the 312 incident had a single-da

View OriginalBecause of my ten-year career in the crypto space, I conducted a so-called ten-year in-depth review, experiencing countless black swan events in the crypto world. Among them, in 2014, the Mt. Gox incident saw Bitcoin plummet by 80%, in 2017 the 94 incident resulted in an 80% evaporation of market value, in 2020 the 312 incident had a single-da

- Reward

- 7

- 2

- Share

GateUser-db80b544 :

:

Take off with strength 🚀View More

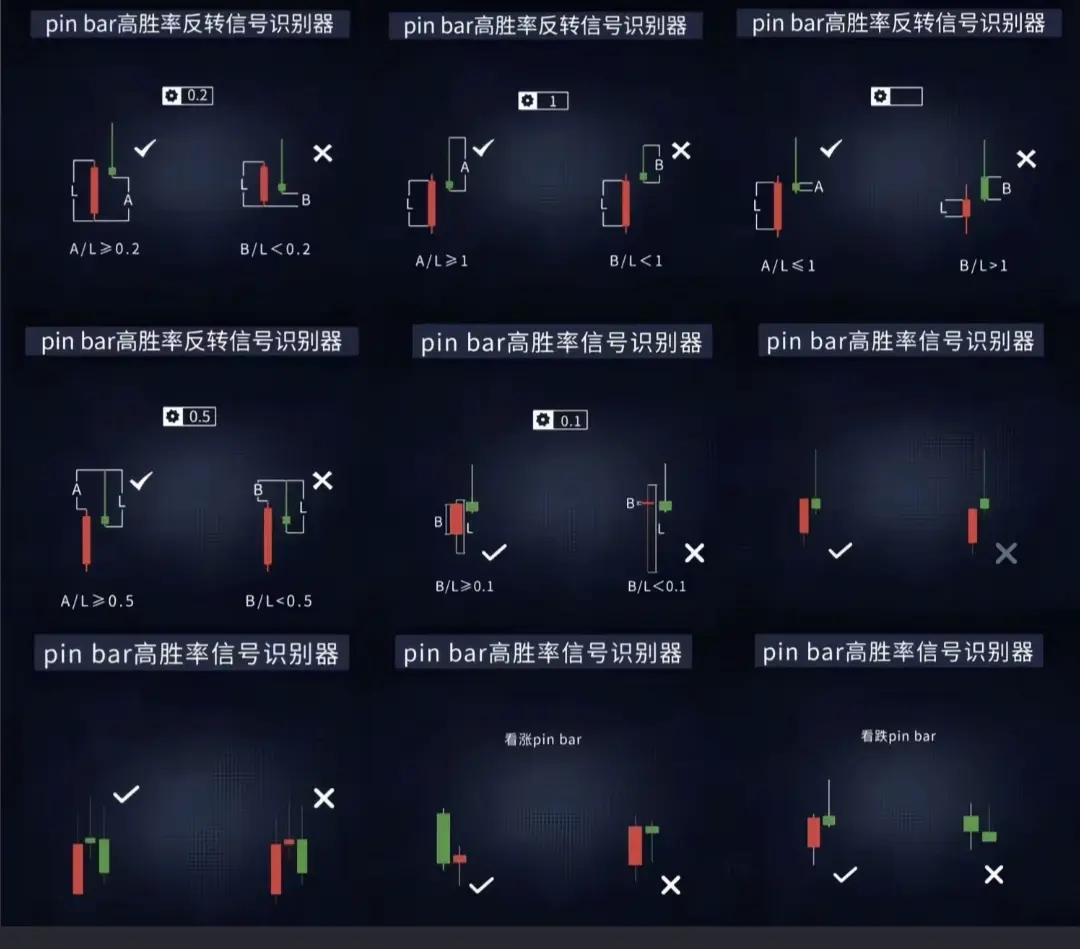

In practical trading, the win rate of the Pinbar pattern is influenced by various factors, including market conditions, time frames, positional structure, and the execution ability of the trader. According to empirical data and statistics from some professional traders, the potential win rate of the Pinbar typically ranges from 55% to 75%, but it must be combined with the following key conditions to leverage its advantages.

High win rate scenarios: When they appear at key support/resistance levels, at the end of a trend (such as a reversal Pinbar after trend exhaustion), or at pullback positio

View OriginalHigh win rate scenarios: When they appear at key support/resistance levels, at the end of a trend (such as a reversal Pinbar after trend exhaustion), or at pullback positio

- Reward

- 1

- Comment

- Share

Dear fans, I will say an important thing once.

A few days ago, I attended a technical exchange conference where there were traders who have been deeply involved for several years, covering foreign exchange, US stocks, digital currencies, futures, and more. We discussed privately how to find the real trading holy grail in digital currencies. I shared a trading technique called pinbar2 with them. Since I have been deeply involved in this crypto space for ten years, I have researched countless indicators, position management, and trading strategies. This year, I returned because I believe that th

View OriginalA few days ago, I attended a technical exchange conference where there were traders who have been deeply involved for several years, covering foreign exchange, US stocks, digital currencies, futures, and more. We discussed privately how to find the real trading holy grail in digital currencies. I shared a trading technique called pinbar2 with them. Since I have been deeply involved in this crypto space for ten years, I have researched countless indicators, position management, and trading strategies. This year, I returned because I believe that th

- Reward

- 3

- 3

- Share

MissXu :

:

Are you in Shenzhen? I also want someone to help me manage my trades.View More

I checked the account situation, it's currently the twelfth day.

The entire process uses low leverage of 3-5 times, reducing risk compared to the previous 10-20 times leverage.

Much lower, adhere to strict risk control, try to enter at key points, utilize

Small leverage, high-frequency arbitrage in a large space, trying to ignore the market as much as possible.

Fluctuations, any volatility is beneficial for my use, real-time can be seen, forced liquidation.

They are all very high, with the liquidation of Bitcoin being tens of thousands of dollars, and Ethereum above a few thousand.

Forced liqu

View OriginalThe entire process uses low leverage of 3-5 times, reducing risk compared to the previous 10-20 times leverage.

Much lower, adhere to strict risk control, try to enter at key points, utilize

Small leverage, high-frequency arbitrage in a large space, trying to ignore the market as much as possible.

Fluctuations, any volatility is beneficial for my use, real-time can be seen, forced liquidation.

They are all very high, with the liquidation of Bitcoin being tens of thousands of dollars, and Ethereum above a few thousand.

Forced liqu

- Reward

- 1

- Comment

- Share

Real account day twelve (pinbar2

The entire process was about crazy arbitrage with small leverage, almost no forced liquidations, ignoring black swans, ignoring large fluctuations, ignoring rises and falls, pinbar2 on the real market. These twelve days have made me deeply understand a truth that I couldn't grasp for ten years: if the positions you hold keep you awake at night, failure and zeroing out are just around the corner. In the past, my leverage was consistently above twenty times, always thinking I was different from others, proficient in various indicators, and with super strong T-tra

View OriginalThe entire process was about crazy arbitrage with small leverage, almost no forced liquidations, ignoring black swans, ignoring large fluctuations, ignoring rises and falls, pinbar2 on the real market. These twelve days have made me deeply understand a truth that I couldn't grasp for ten years: if the positions you hold keep you awake at night, failure and zeroing out are just around the corner. In the past, my leverage was consistently above twenty times, always thinking I was different from others, proficient in various indicators, and with super strong T-tra

- Reward

- 2

- 3

- Share

BraveFrog :

:

Awesome👍View More

- Reward

- like

- 2

- Share

MissXu :

:

Where is it in Shenzhen?View More

The seventh day of the real account.

I once did a hundred times real trading for half a year. 1 I used leverage of ten times to twenty times or more each time. 2 I often entered the market early. 3 I held onto positions with reverse operations. A few years ago, during that hundred times real trading, I also held a short position on Ethereum, from 2500 to 4000. Because I used high leverage, I ended up not sleeping for more than a month, day and night trading. I pulled the liquidation price from 3000 all the way up to over 4000, and in the end, I was just a few dollars away from being liquidated

View OriginalI once did a hundred times real trading for half a year. 1 I used leverage of ten times to twenty times or more each time. 2 I often entered the market early. 3 I held onto positions with reverse operations. A few years ago, during that hundred times real trading, I also held a short position on Ethereum, from 2500 to 4000. Because I used high leverage, I ended up not sleeping for more than a month, day and night trading. I pulled the liquidation price from 3000 all the way up to over 4000, and in the end, I was just a few dollars away from being liquidated

- Reward

- 57

- 5

- Share

Flowergirl34 :

:

1000x Vibes 🤑View More

Let's just say the important things once.

Perhaps due to being outdated, my posts sometimes feel like they lack any sense of presence or resonance. Maybe the reason is that while other places are quite lively, there are many old friends here, so I can only be half in and half out.

Once here, a hundred times real trading in half a year, completely public, 21 years

At that time, I looked at the fans, and more than half were gone, either having changed places or having withdrawn. Suddenly, I didn't know what to say, feeling like I was fighting alone. It's very normal; as a trader, it's destined t

View OriginalPerhaps due to being outdated, my posts sometimes feel like they lack any sense of presence or resonance. Maybe the reason is that while other places are quite lively, there are many old friends here, so I can only be half in and half out.

Once here, a hundred times real trading in half a year, completely public, 21 years

At that time, I looked at the fans, and more than half were gone, either having changed places or having withdrawn. Suddenly, I didn't know what to say, feeling like I was fighting alone. It's very normal; as a trader, it's destined t

- Reward

- 54

- 9

- Share

YearsThoseYears :

:

I want to learn how to live stream.View More

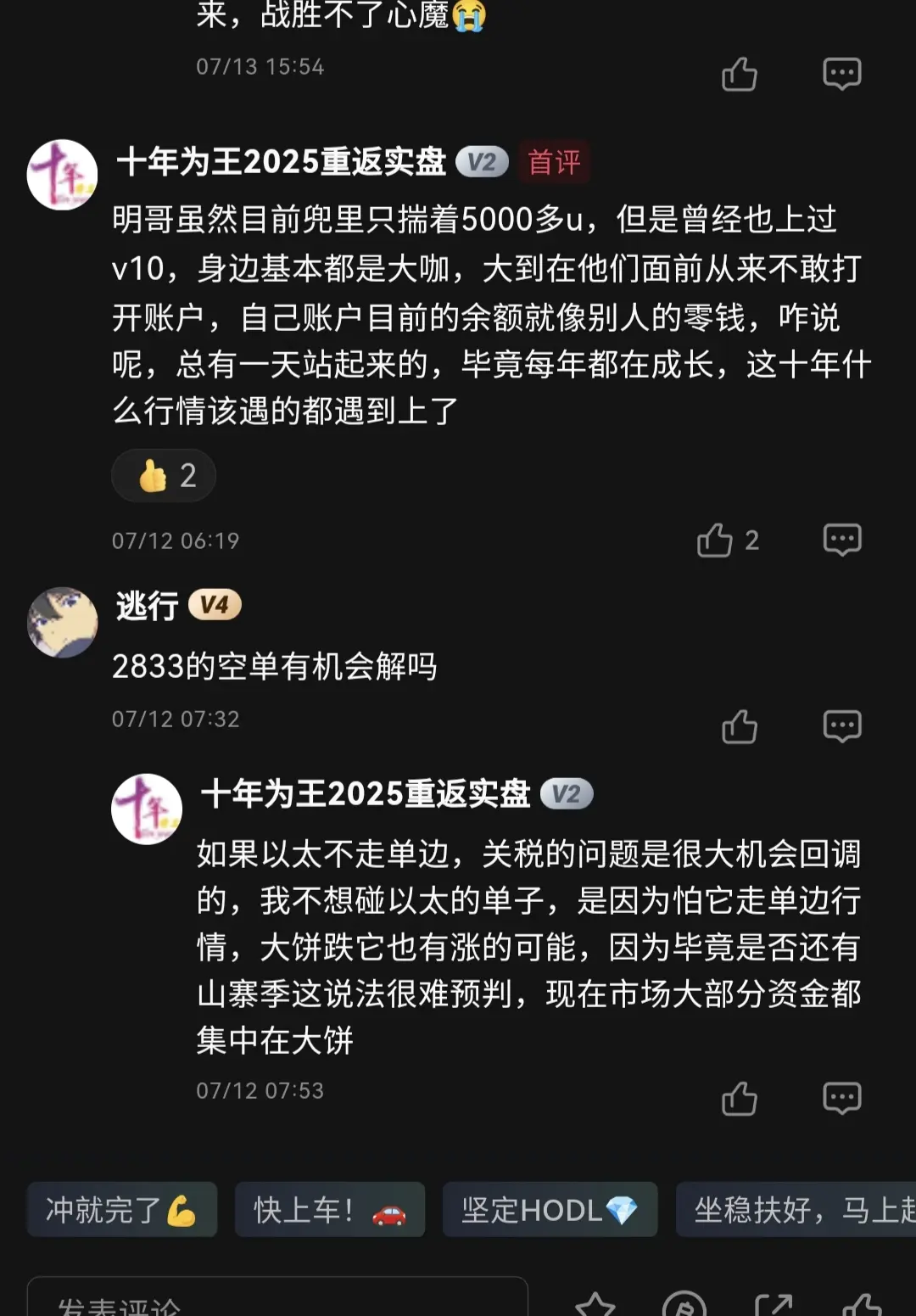

I don't know how my little brother who just followed me is doing with his Ether order.

The fan brother's short order at 2835, when he commented on me it was at 2935, Bitcoin surged to 122000, and when Ether broke 3000, Bitcoin started to pull back. I feel that this short order is actually quite unfavorable. 1. After all, it is impossible to determine whether the altcoin season will still exist. If it does, it would be normal for Ether to surge to 4000 or 5000. 2. Bitcoin repeatedly breaks new highs, while Ether has not exploded at all in this bull market. Shorting at 2900, it still has a poten

View OriginalThe fan brother's short order at 2835, when he commented on me it was at 2935, Bitcoin surged to 122000, and when Ether broke 3000, Bitcoin started to pull back. I feel that this short order is actually quite unfavorable. 1. After all, it is impossible to determine whether the altcoin season will still exist. If it does, it would be normal for Ether to surge to 4000 or 5000. 2. Bitcoin repeatedly breaks new highs, while Ether has not exploded at all in this bull market. Shorting at 2900, it still has a poten

- Reward

- 23

- 4

- Share

TenYearsAsKingIsOn :

:

Choose Short Position and wait, a good entry position is quite important. My BTC position at 117000 was early by two or three thousand dollars, but with small leverage and flexible operations, in a few days, it returned to my entry price of 117000, and I could make a 10%-20% profit. After all, my liquidation price for tens of thousands of dollars is below 5x leverage. If you insist on making orders for Ether, my personal opinion is that you can't predict the top. It hasn't broken a new high, and even if it does, I don't know where the top is. If you short it, you might be afraid it will pump to a new high. If you go long, it's not a good idea either. The previous resistance was at 1390. Personally, I only allow a position of one-tenth, and only when certainty is relatively high. With small leverage, I do more day trading and just make some profits. More than 90% of the chips are in BTC.View More

My ten years also belong to your ten years.

#BTC# Actions speak louder than words. If we say we'll do it, we'll do it. Let's clean up, set up a network cable, and take care of our old fans.

Build a communication live broadcast room that belongs to you, brothers.

View Original#BTC# Actions speak louder than words. If we say we'll do it, we'll do it. Let's clean up, set up a network cable, and take care of our old fans.

Build a communication live broadcast room that belongs to you, brothers.

- Reward

- like

- 2

- Share

Dyshj :

:

Waiting for you to start the broadcast 😁View More

In the past, during the highlights, when I achieved a hundred times the actual performance and had outstanding results, many fans including the official management hoped that I would livestream. Fans also wanted to fight alongside me and share their views on the market in real-time, rather than just focusing solely on my own actual trades.

There were always many reasons back then, one might be laziness, and another might be the issue of camera anxiety. Each time I made excuses, and after a few years, I still haven't discussed the market with my brothers in the live broadcast room, not even for

View OriginalThere were always many reasons back then, one might be laziness, and another might be the issue of camera anxiety. Each time I made excuses, and after a few years, I still haven't discussed the market with my brothers in the live broadcast room, not even for

- Reward

- 59

- 8

- Share

TurtleKing :

:

It's over

View More

Since 100000, I have been choosing to hoard U and hoard bullets, always in a Short Position, 105000 Short Position, 110000 Short Position, 115000 Short Position, always in a Short Position until 118000, and I watch the market every day. Things that I couldn't do before, I can do now.

This wave of Short Position observed several hundred so-called signal candlesticks, and several times it was a false short, including the last spike to 79000. Without any significant good news, the tariffs were restarted and negotiations took place, surprisingly pushing back up by twenty thousand dollars, squeezin

View OriginalThis wave of Short Position observed several hundred so-called signal candlesticks, and several times it was a false short, including the last spike to 79000. Without any significant good news, the tariffs were restarted and negotiations took place, surprisingly pushing back up by twenty thousand dollars, squeezin

- Reward

- 16

- 8

- Share

TenYearsAsKing2025R :

:

I won't touch any orders except for BTC, the rise and fall of altcoins are uncertain, avoiding holding a losing position.View More

At this moment, I just want to leave myself a sentence.

It has been ten years; it's time to settle down and it should have settled down by now. It's time to do nothing.

Wait, no market will be tempted anymore, once it was ten times in a month.

In six months, a hundred times, from this moment on, everything is in the past!

I no longer pursue it either, with 5000u in my hands, what I should do is to put

Leverage reduced by ten times, those who are good at trading, even with just one times the spot, take risks.

The risk of 1x leverage, performing high-end operations, can also yield five.

Leverage

View OriginalIt has been ten years; it's time to settle down and it should have settled down by now. It's time to do nothing.

Wait, no market will be tempted anymore, once it was ten times in a month.

In six months, a hundred times, from this moment on, everything is in the past!

I no longer pursue it either, with 5000u in my hands, what I should do is to put

Leverage reduced by ten times, those who are good at trading, even with just one times the spot, take risks.

The risk of 1x leverage, performing high-end operations, can also yield five.

Leverage

- Reward

- like

- 6

- Share

AboutFog :

:

Hurry up and enter a position! 🚗View More

I am ready for what needs to be prepared, now waiting for the entry signal. This number is not convenient for live streaming later, so for the brothers who are following, if you want to see the actual market or fight alongside, you may need to trouble yourself to click on my follow and click on follow again.

The funds have been transferred there for placing orders, waiting for a signal to start entering the market. The market is uncertain, keep the position empty! When the market is confirmed, build positions in batches, low leverage, avoid frequent trading, don't cling to battles, and win eve

View OriginalThe funds have been transferred there for placing orders, waiting for a signal to start entering the market. The market is uncertain, keep the position empty! When the market is confirmed, build positions in batches, low leverage, avoid frequent trading, don't cling to battles, and win eve

- Reward

- like

- 10

- Share

LittleCrocodileIslandMaster :

:

Already followed, it's done 💪View More

When BTC was at 95000, the account had over 1k u, and I kept a Short Position without moving, insisting to enter the market with 5000 u.

When BTC is at 110000, the account has over 2k u, and I have been holding a Short Position without moving, insisting on entering the market with 5000 u.

When BTC was at 112000, the boss in the institution said to give me an additional 5000u in advance so I could seize the opportunity. I thought about ten years of trading, and once it broke through 112000, it could really reach 115000 or even 120000. I still chose to remain inactive and insisted on entering th

View OriginalWhen BTC is at 110000, the account has over 2k u, and I have been holding a Short Position without moving, insisting on entering the market with 5000 u.

When BTC was at 112000, the boss in the institution said to give me an additional 5000u in advance so I could seize the opportunity. I thought about ten years of trading, and once it broke through 112000, it could really reach 115000 or even 120000. I still chose to remain inactive and insisted on entering th

- Reward

- 1

- 7

- Share

TheNewRichestManInT :

:

Are we going to empty it?View More